Should I invest in the Stock Market or Multifamily Real Estate? This debate has been trending over the years among new and seasoned investors alike. However, to make money with either investment requires that you understand the positives and negatives of both. In this article, we’ll analyze the Stock Market versus Multifamily Real Estate so that you can choose the best route for yourself.

INVESTING IN STOCK MARKET

Investing in the stocks does not require much work at your end. It only involves purchasing shares of a business. You are only buying a claim of the company, you’re not an employee nor do you participate in any management decisions of the company. Stocks are more liquid assets, easy to buy and sell.

Investing in Multifamily Real Estate

Multifamily real estate is a real investment. You can touch, feel and inspect the property that you own. You as the property owner have total control over the value and use of your investment. Typical investing strategies include land development or acting as landlords for rental purposes. Most investors generate income through rent and leases.

WHAT ARE AVERAGE STOCK MARKET RETURNS?

We must first determine what returns “Stocks Market Vs. Multifamily Real Estate” has before we can answer the question, which one should you choose. However, the average returns of the stock market are well studied – It is widely known that the stock market has around 10% returns per year, and approximately 7% once adjusted for inflation.

WHAT ARE AVERAGE MULTIFAMILY REAL ESTATE RETURNS?

This is a tricky question but also very simple. The key to multifamily real estate investment is its ability to produce cash flow. The first thing we’ll discuss is Capitalization Rates.

Capitalization rates are defined as the ratios of income from a property net all operating costs to the price. In all multifamily real estate, (5+ unit), Cap Rates are used to determine the overall returns of an asset.

Therefore, if a property has a 7% capitalization rate, also known as a “7 cap” property, it would have a total return of 7% annually. For instance, if you purchased a rental property for $200,000 cash, you could expect a total return of $14,000 per year.

If you’d like to beat the stock market, start by investing in property with a 7.2% cap rate or higher, and assuming the property continues to perform as it has in the past and you win. In addition, depending on the location of your real estate, your ability to increase income and lower expenses, you can enjoy even larger returns on your investment. At MI Real Estate, we only invest in properties that project to yield average annualized returns of 12% or higher. Wish to take a deep dive? Then let take a look at real estate as a whole.

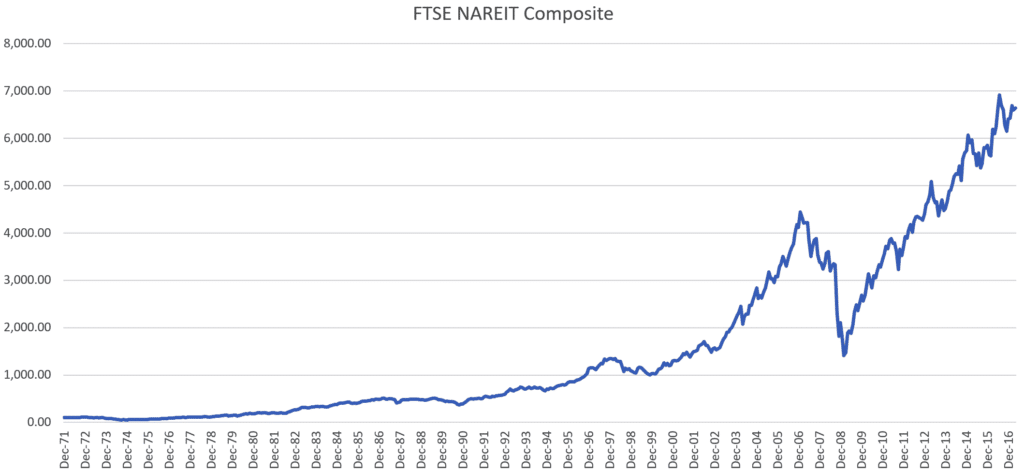

The FTSE NAREIT Composite Index has been tracking real estate investment trusts in the US since 1972. Exchange-traded FTSE NAREIT makes their information publicly available allowing us to estimate returns and follow them with accuracy.

This graph shows that a $100 investment in 1972 would be worth about $6,839 as of 2016. This is a total of 68x your initial investment and a total Cap Rates of around 9.425% return annually. Moreover, the numbers highlight that real estate has outperformed the stock market since 2000, and is roughly in line with the S&P 500 since 2011 at a ~12% average annual return.

STOCK MARKET VS. MULTIFAMILY REAL ESTATE: WHICH IS BETTER?

Yes, the returns are higher in multifamily real estate than in the stock market, but the answer isn’t so simple. Both options have their pros so let’s take a look at some other advantages for multifamily investing.

HEDGE AGAINST INFLATION

Investing in multifamily real estate has a potential hedge against inflation as historically rental rates and cash flow have kept its pace with inflation. It means that market values for rental properties automatically rise as the cost of living increases. However, this is not the case for stock investors. Although stock market prices do grow over time, but traditional equity investments are not linked to inflation.

1. CONTROL OVER THE INVESTMENT

2. LEVERAGE TO BUILD WEALTH

2. LEVERAGE TO BUILD WEALTH

3. TAX BENEFITS

4. ABILITY TO INCREASE NOI

NOI is a key metric for investors. Multifamily real estate investors can increase their Net Operating Income (NOI) and make their investment more profitable. In simple words, this means reducing overhead costs and improving your cash flow as well as increasing the property’s value. However, for most stock market investors, this is almost impossible to do.

From the pros above, you can see that multifamily real estate is a great investment. The investor can continue to make money in the long run while also enjoying their investment. Therefore, when considering the question “Stock Market vs. Multifamily Real Estate,” Think about how tangible the asset is. Businesses come and go, but multifamily real estate is there forever.

WAYS TO INVEST IN MULTIFAMILY REAL ESTATE

Investing in multifamily real estate is not as easy as buying any property and selling it later for a higher value. To ensure you invest in the right properties takes work and knowledge. It begins with you doing your homework and investing in the right multifamily property, partnering up with a company and/or individuals with a solid reputation and sound strategy, or a combination of the two.