Investing in multifamily real estate is a constant learning experience; as you become more experienced, you learn how to evaluate each multifamily market phase more quickly. It should go without saying that you can invest in multifamily real estate when the market is up, but should you invest when the market is down?

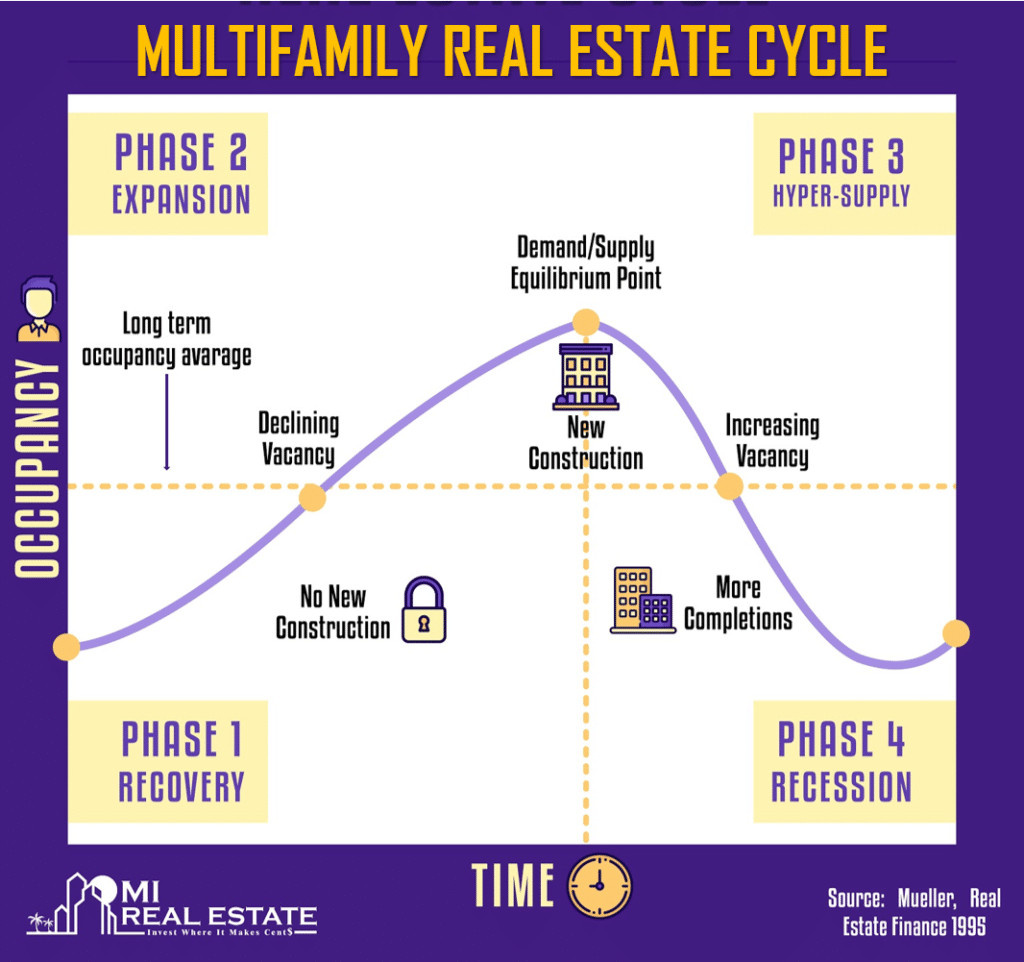

Similar to the economy in general, there are four phases to the real estate cycle– recovery, expansion, hyper supply, and recession. Typically, the cycle repeats in waves. As explained below, the multifamily real estate sector is considered one of the most “defensive” areas of real estate. Therefore, it’s possible to invest successfully throughout all phases of the multifamily market cycle.

WHAT CAN REAL ESTATE INVESTORS LEARN FROM EACH MULTIFAMILY MARKET PHASE?

Having a general understanding of a multifamily cycle’s phases can assist you in making sound investment decisions.

Below, we will discuss the four economic phases of the Multifamily Real Estate Investing Cycle.

THE RECOVERY PHASE

During the recovery phase, typically, there is little to no new construction and construction job rates in most markets are slowly decreasing. While it is true that the average multifamily property will have steady occupancy rates even during the recovery phase, some property owners may have difficulty keeping their properties at a high occupancy rate of over 95%. Moreover, there are several other signs that the market is in the recovery phase.

Typically, rent growth hovers near the inflation rate, rather than increasing substantially.

Businesses in the area are starting to generate new growth and hire new employees, which will subsequently produce a higher demand for housing in those job markets.

In general, during the recovery phase, cash buyers can do quite well. Likewise, sellers are in a much better position to sell, as well. This is a terrific time for experienced investors to hold on to assets until the expansion phase. Cash is king during the recovery phase. Especially because it may be tough for average investors to obtain financing

THE EXPANSION PHASE

Overall, the expansion phase is both a seller’s and buyer’s market: sellers will gain from selling at greater rates than the recovery period. In contrast, buyers will value having the ability to buy multifamily houses in a growing market.

At the peak of the expansion multifamily market phase, supply and demand are balanced. The expansion phase is a great time for investors who can purchase properties at a discounted price, hold, and renovate the properties so that they can sell at a premium in the upcoming years.

HYPER SUPPLY PHASE

The next phase in the multifamily market phase is hyper supply: a period when the marketplace experiences an oversupply of rental properties. New buildings and construction are still feasible; however, the market or neighborhood is oversaturated.

Instead of new structures filling quickly, they might take longer to lease-up. The supply is increasing, making it a tenant’s market, rather than a landlord’s market.

Likewise, during the majority of the hyper supply phase, it’s a seller’s market as some buyers don’t recognize the oversupply until late in this phase and sellers aren’t willing to budge on pricing until buyers stop buying.

RECESSION

Typically, during this multifamily market phase, the real estate market is oversaturated with supply, outweighing demand. This is a buyer’s market, but as financing also tightens up, cash buyers stand to profit the most. Consequently, developers start little to no new construction projects during a recession. You will also probably see interest rates increase. In most instances, your vacancy rate may also increase.

THE VERDICT

Multifamily apartment buildings tend to be less susceptible to financial cycles, considering that everyone needs somewhere to live. This is true even though a down economy may trigger substantial job losses in some markets. In general, the verdict is that investors can invest successfully throughout each multifamily market phase. Especially if they fully appreciate the pros and cons of each phase.