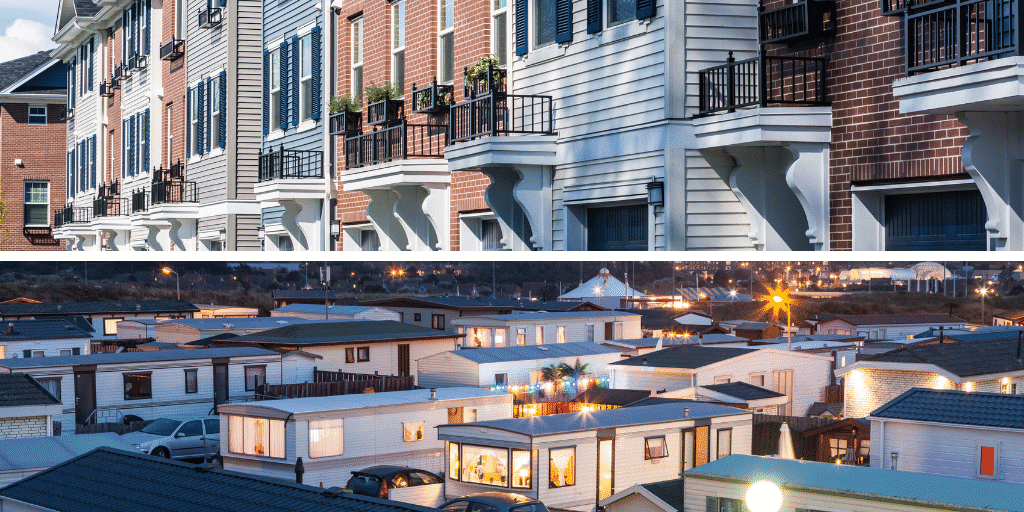

MULTIFAMILY APARTMENTS VS. MOBILE HOME PARKS INVESTMENTS • THE UPS AND THE DOWNS

When you try to compare investments in multifamily apartments (MI) with mobile home parks (MHP), you’ll find that it’s hard to do a side-by-side comparison. However, there are some definite pros and cons to each type of investment.

For instance, there are many variables that come into play, but generally speaking, mobile home parks usually cost less than a multifamily apartment dwelling. Therefore, your initial costs will reflect this making it easier for people with limited cash to invest in an MHP. But, of course, the lower investment means lower appreciation in many cases.

Nevertheless, there are many caveats to learn about with these two types of investments. To help you get started, I’ve listed some considerations below that look at the ups and downs of these two types of investments.

↑ GOOD FINANCING AVAILABILITY (MI)

First, multifamily financing is for the purchase or the refinance of properties that have five or more units. Next, while an MHP is exclusively a land buy (in most MHP deals), multifamily apartments are dwelling investments and it’s easier to finance than it is to get a loan for a land buy.

The down payment from the investor is the first requirement. Once you get past that, it’s easier to get a loan on a multifamily apartment complex.

Mobile home parks will have the lowest appreciated values over time and selling is difficult because there’s an exceedingly small pool of investors. Conversely, a multifamily unit has great income potential if your purchase price is right. That’s one reason I prefer multifamily apartments for a safer investment.

Now to further your knowledge, let’s delve into the top 4 loan types for multifamily apartments.

• 4 MAIN LOAN TYPES FOR MULTIFAMILY APARTMENT INVESTMENTS

- Conventional Mortgage

- Conventional mortgage loan rates are either fixed or variable. While variables usually reset after the first seven to 10 years, fixed rate mortgages are fully amortized throughout the life of the loan. Variable interest rates are capped at the current starting interest rate plus 5 to 6 percent.

- Government-backed Loan

- Fannie Mae and Freddie Mac are the government-backed multifamily loans. This type of loan must meet standards as set by the Federal Housing Administration (FHA). Within this loan category, there are five different options that finance properties that are either two to four units or five or more units.

- Portfolio Loan

- This is a nonconforming loan for the purchase of a multifamily property with two units or more. What’s even better is you can finance multiple properties at one time with this loan program.

- Short-term Multifamily Loan

- This is a good short-term loan program for investors who plan to renovate or increase the occupancy to be able to meet the stricter requirements of traditional financing. Repayment of these loans is usually interest-only and range from six to 36 months. However, they are perfect if you need to wait until you can meet the requirements for a better loan product such as higher occupancy rates, increased loan amount, etc. This is especially useful for value-add investing, where one increases the property’s Net Operating Income by upgrading the property to drive up rents and/or improving operations to reduce expenses.

↓ FINANCING IS HARDER TO FIND (MPH)

While MHPs have similar loan types to multifamily apartments, fewer banks are willing to give out loans on Class C mobile home parks; most available loan products are for Class A and B properties. So, there is less traditional financing available and instead, you have to turn to more creative financing options such as private money. Additionally, there is also the possibility of an owner-financing option. However, as with all non-traditional lenders, the interest rates are higher, require larger down payments, and the length of the loan may even be shorter than a traditional loan.

This not only makes it difficult to purchase an MHP that you can drive up the value, but it also makes this type of investment difficult to sell than apartments. You see, if the property doesn’t qualify for a traditional loan, there will naturally be fewer people who show interest in the property when it comes time to sell.

↓ HIGHLY PROTESTED ZONING ORDINANCES (MHP)

Mobile home parks are normally not welcome and meet with resistance from neighbors and city officials. Whether or not it’s justified, the fact remains that it is a barrier to successful mobile home park investments.

Even after an MPH is in place with people living in their homes, re-zoning can still take place and forced relocation becomes a reality for the mobile homeowners, not to mention the loss to the park investors.

↓ INCREASED SUSCEPTIBILITY TO INCLEMENT WEATHER (MHP)

I think we’re all aware of the catastrophic damage to mobile homes that hurricane season can bring. One swoop of even a Category 1 hurricane through a mobile home park has the ability to destroy hundreds of mobile homes. With no traditional foundation, these homes are wide open to severe damage under the right weather conditions.

What’s more, this type of devastation will have serious implications on the investors of a mobile home park.

↑ GREATER LENGTH OF TENANCY (MHP)

First, in a mobile home park, only the land and any amenities are owned by MHP investors. Moreover, most units in an MHP are owned by individual homeowners. So, they have to move the whole house and that can get highly expensive and quite often cost more than the value of the home. When you think about the expenses of the movers, the disconnect and reconnect of the utilities, the removal and reapplying of the aluminum skirting and other miscellaneous tasks, you can understand why.

As a result, there’s a lower rate of turnover than you will find in a multifamily complex. Statistics show that an apartment dweller will stay an average of two years while mobile homeowners will rent the land and amenities from the park owner an average of five years.

However, it takes a great deal of effort to purchase a new mobile home, rent a space and then move the home into the MHP. Therefore, it’s going to be a lengthier process than cleaning and repairing an apartment.

↑ LOWER MAINTENANCE COSTS (MHP)

Mobile homeowners do most of their own maintenance which relieves the park owners of this expense. However, that also means that the park owners have very little quality control over the maintenance or lack thereof that the owners choose to perform.

That fact alone has some bearing on the value of the entire MHP and can affect the investors adversely or positively depending on the standards of the park and how well the homeowners respond to them.

↑ HIGH DEMAND FOR MULTIFAMILY APARTMENTS (MI)

Do you know that in an incredible low, only 63 percent of people now own their homes? This is a 50-year low in the current housing market. The affordability of apartment rentals and lifestyle changes are the primary reasons why this happens.

In the past 10 years, there are millions of homeowners who brought their lifestyles down to a more affordable level. The greatest percentage did this by moving into a multifamily apartment complex. That’s why “now” is the time to consider investments in multifamily syndications or joint ventures.

↓ LOSE VALUE FASTER (MHP)

It is worth noting that a mobile home will lose its value faster than an apartment complex. First, these homes are governed by the Department of Motor Vehicles because they are mobile. Moreover, by virtue of being mobile and without a foundation, they are simply not as long-lasting as an apartment building.

The impact to MHP investors is that the faster deterioration could reduce the attraction to prospective mobile park home clients. That makes proactive property management an absolute must.

However, to counteract this, some mobile home park owners set standards that homeowners have to meet. Those expectations might include the requirement to have only double-wide homes in their park. Other requirements might include high-grade siding or fully shingled roofs.

↑ MULTI-FAMILY PROPERTIES HOLD VALUE (MI)

Multifamily properties give investors of a real estate syndication or joint venture 4 basic way to increase values:

- Appreciation of equity

- Cash-on-cash returns

- Debt pay down – funded by renters

- Tax depreciation income tax shield

- MHPs generally depreciate on an accelerated schedule because improvements are solely to the land, which increase tax savings.

However, the bottom line remains that if an apartment complex doesn’t cash flow, it likely wasn’t acquired correctly and/or isn’t being managed correctly. Likewise, if you want your portfolio to remain intact, you need cash flow while you build more equity. The improvement of this process is up to the syndication sponsors and/or management team which involves lenders, vendors, utilities, communities, and community managers.

Your syndication sponsor(s) build these relationships to keep the operation of the project flowing smoothly with good cash flow. All you need to do is sit back and collect your incoming checks.

IN CONCLUSION

Let’s face it. When you consider that multifamily properties hold their value over mobile home parks, have good financing options available, and are in high demand, it’s an exciting thumbs up for this type of investment.

Let me know what your thoughts are in the comments below, or call or send a message. I am happy to answer all questions you might have about multifamily syndications and joint ventures. They are a great alternative for passive income for your portfolio. Additionally, below you will find related topics of interest.