MULTIFAMILY INVESTING AFTER CORONAVIRUS

On March 11, 2020, the World Health Organization (WHO) shook the entire world when they publicly labeled, the novel coronavirus, (COVID-19) as a global pandemic. As such, the COVID-19 pandemic continues to alter every aspect of our lives. Here, we will discuss how multifamily investing, will be affected by the COVID-19 pandemic.

COVID-19 AND THE REAL ESTATE INDUSTRY

The U.S. housing industry is on a bit of a lockdown at the moment. The sales centers of many new developments are empty. Additionally, in the majority of states across the US, real estate agents can’t even show properties.

LOWERS INTEREST RATES

Last month, the Federal Reserve lowered interest rates to zero.

So, with the lower interest rates, how exactly will the multifamily real estate market perform during the global COVID-19 pandemic? Well, even though real estate has a reputation for being recession-proof, the reality is that no investment, including real estate, is truly recession-proof. Let’s call it recession-resilient.

HOW WILL REAL ESTATE SURVIVE COVID-19?

Generally, real estate performs better than other investments during recessions.

HISTORICALLY MULTIFAMILY INVESTMENTS PERFORM BETTER DURING A RECESSION

Compared with other sectors of the real estate industry, expert expects multifamily properties to be impacted less in the short term.

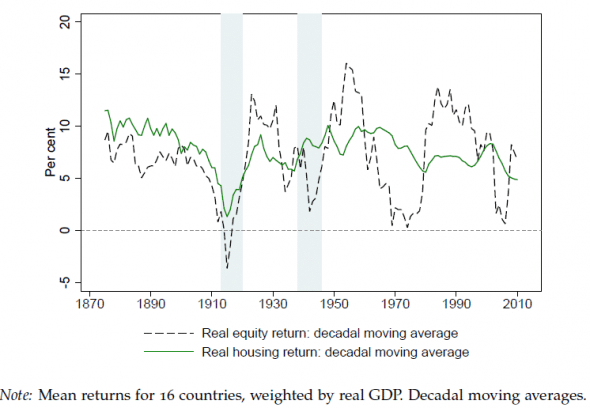

Throughout modern history, residential real estate has enjoyed an extremely high rate of return with low risk. Take a look at volatility for real estate vs. stock for the past 145 years:

SHOULD YOU KEEP YOUR FAITH IN MULTIFAMILY INVESTING?

While cash is king with multifamily real estate investing under normal financial conditions, during a recession, cash flow is even more important. The more income a property can generate only helps to cover its mortgage payments and other property-related expenses.

Diversification in your multifamily investment portfolio can also lessen your financial risk during the COVID-19 pandemic and beyond.

THE MARKET WILL REBOUND EVENTUALLY

History tells us that the financial markets will eventually recover. And, while it’s still too early to assess the full economic impact of the COVID-19 pandemic, during past recessions, the markets stabilized within three to six months on average. The beautiful thing about multifamily investing is that there is a constant demand for housing in growing markets. This is even true for multifamily properties located in lukewarm markets. In secondary markets, investors can still make substantial profits by optimizing their operating strategies to maintain high occupancy rates, reduce vacancies, and lower operating expenses.