Everyone dreams about the lifestyle of being able to spend what you want and work when you want – wherever you want! But what a lot of people don’t realize is that it takes planning and facing daily challenges to get to reach your financial goals. But, if you’re willing to do the research and invest wisely it is entirely possible for you to set financial goals today to reach the level of financial freedom that you desire sooner.

Living with a few financially tight squeezes now to invest your money in the right ventures might pay off tenfold in the future. With the right financial goals and the right investments you make today, you may expect a rewarding return on your investment.

But, do you want to wait for 30 – 40 years to enjoy that income? If you’re reading this article, your answer is most likely a resounding “no!” Of course, that begs the question, “How can I make passive income now and in the future?” Keep reading to learn easy ways to set your financial goals and how to reach them.

CLEAR YOUR MINDSET ● THINK ABUNDANCE!

Wouldn’t you rather occupy your time with family, travel, or hobbies than being glued to the monitor for updates on the stock market to reach the lifestyle you desire? There is a better way.

The greatest financial wizards in the world are foremost, abundance thinkers. They take action to create renewable and passive income streams. What’s more, you don’t find them sitting around wondering how to make their next check stretch out long enough to make it to the next one.

Instead, they’re proactive in their investments to generate renewable and passive income through real estate. They, like you, are interested in this because real estate has proven throughout time to help people reach their financial goals like no other investment tool.

Tip o’ the Hat to Multifamily Cash Flow – Abundance Thinking

DEPENDABLE MONTHLY INCOME

We know that income is the reason we invest in real estate. But why do we advise to invest in real estate over stocks and bonds? To illustrate this point, let’s take a quick look at this table that compares and calculates yearly income (pretax) across three investment types.

| Type of Asset | Income Yield | The Income per Year for Investment of $450,000 |

| Unleveraged Rental Property | 7% | $31,500 |

| 10-Year Treasury Bond | 2.83% | $12,735 |

| S&P 500 Index Fund | 1.86% | $8,370 |

After considering these figures, where do you think you’ll invest your money? That’s an easy answer but, the next question is how to determine what you need for retirement.

CONTROL MAKES A DIFFERENCE IN YOUR INVESTMENT SUCCESS

If you want more control over your investments, real estate is the answer. Non-real estate investing is dependent on the appreciation of pricing structures and while stock indexes may be reliable over the long run, they get extremely volatile over the short run. That means that a sudden drop in stock prices will set you back indeterminately in reaching your financial goals.

Conversely, real estate gives you predictable growth:

- Consistent positive rental income, and,

- sequential debt amortization or paydown.

Additionally, we must remember that even though no investment is a guarantee of success, properties remain the most stable, overall.

Tip o’ the Hat to 5 Reasons Real Estate is the Perfect Early Retirement Tool

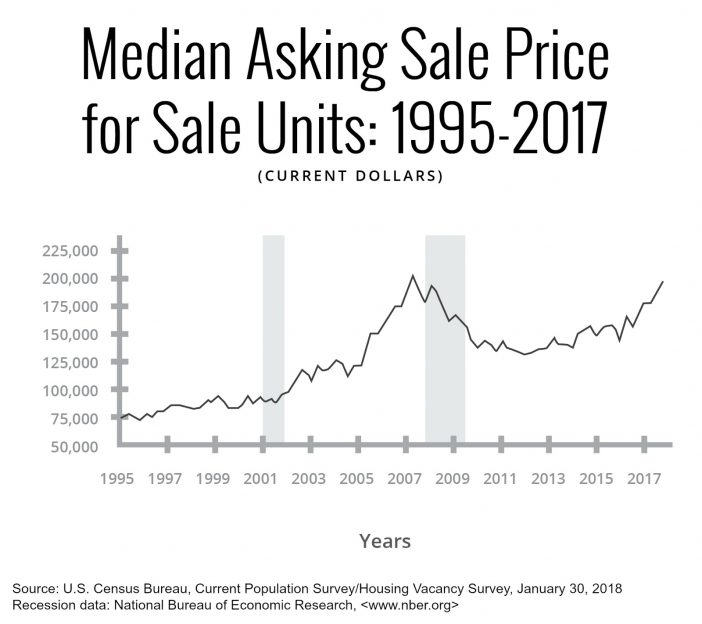

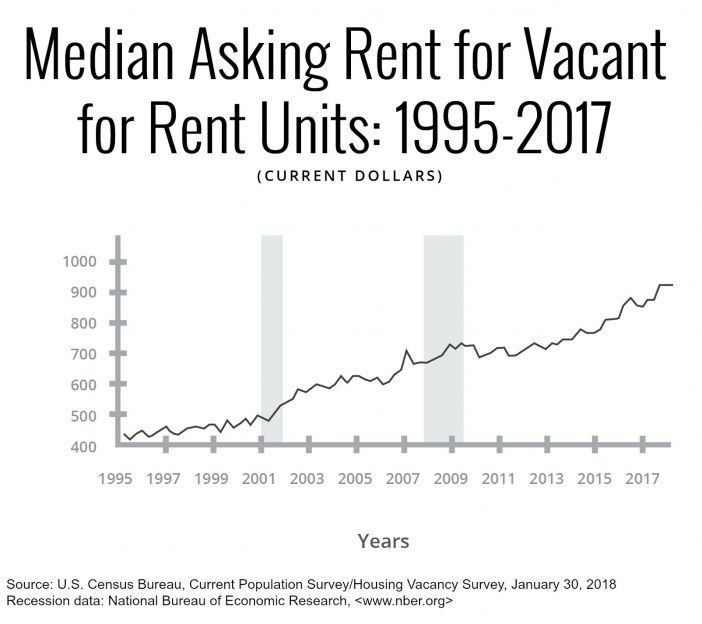

As illustrated clearly by these charts, even though housing prices dropped drastically during the 2008 – 2010 drastic economic downturn, rents held strong or went down only slightly.

However, be certain to consider that these past facts do not mean the same results will occur in the future. For instance, you must do your research into the existing rentals in the area in which you wish to invest. Differing geographical areas often mean differing results. This is one of the ways that your control as an investor comes into play.

REAL ESTATE INVESTING AND THE TAX CODE

The current tax code works in favor of real estate investors. The following is a list of a few examples of the amazing tax benefits that real estate investors enjoy:

● RENTAL INCOME:

There are no Social Security nor Medicare deductions taken from your rental income.

● DEPRECIATION:

A depreciation expense shelters your rental income from taxes and reduces your tax bill over 27.5 years (residential).

However, if you sell, you’ll have to pay taxes on the depreciation. But, there is a way around this with a 1031 tax-free exchange.

● 1031 TAX-FREE EXCHANGE:

Section 1031 of the U.S. tax code allows you to trade one property for another which allows growth and compound gains with deferred taxation.

● CAPITAL GAINS:

Long-term investments are those held over 12 months are usually at lower tax rates than the same earnings from a W2 job.

WHY MULTIFAMILY IS YOUR BEST TOOL FOR FINANCIAL GOALS

Multifamily has consistently outperformed the conventional stock market since 2000. Moreover, it is in line with the S&P500 since 2011 at a 12% average annual return!

Additionally, multifamily investments give you the diversity of investments in terms of niche, geography, and sponsors. It also affords single investors access to larger investment properties.

If you decide to invest in multifamily syndication you may look forward to handing most of the responsibilities over to a sponsor. All you have left to do is sit back and watch your checks roll in.

Add to that the myriad of tax benefits you receive as a multifamily investor and you’ve got a faster track to retirement than you might imagine is possible.

So, if you have a late start in planning your retirement, multifamily investing should be at the top of your list for consideration. The sooner you check into this important aspect of your future life, the sooner you will be on board and wondering why you didn’t act faster.

HERE’S TO YOU & YOUR FAMILY’S FUTURE LIFESTYLE!

First, stop depriving yourself of what you can build for the future. Next, I encourage you to start planning today and embrace the daily challenges you meet today that enable you to reach your financial goals of the future.

I understand that this is a lot of information to try and fit together so that it all makes sense, so please feel free to contact me if you’d like to get started but don’t know the way. I am here to show you how to reach your dreams and goals.