Investing your money in a recession-resistant real estate investment is more important than ever in today’s economy. Up until now, the stock market might be where you invest your money, but that can be a huge risk, especially when a recession comes along unexpectedly. Instead, it might be time for you to consider a different type of investment in recession-resistant real estate based on lifestyles rather than an up and down economy.

WHAT IS A RECESSION RESISTANT REAL ESTATE INVESTMENT?

Historically, all real estate goes up and down within its current economy. But, recession-resistant investments are not as affected by the volatility of a current economy. By definition, experts tell us that “Recession Resistant Real Estate Investments” are instead tied to lifestyle trends as opposed to economic cycles. One excellent example of this type of property is senior housing.

With the golden years looming for millions of baby boomers along with the fact that they historically change, well, everything, they are also changing the landscape of senior housing as they retire. For one, they seek a more urban environment than ever before and remain much more active as they grow into their senior years than the generations that came before. Additionally, the baby-boomers’ expectations include not only living assistance when needed but also social interactions and entertainment.

All that adds up to many changes across the continuum brought about by the sheer numbers of this incredible generation. Needless to say, baby boomers literally change real estate investment opportunities and the prospects of future construction in the category of senior housing.

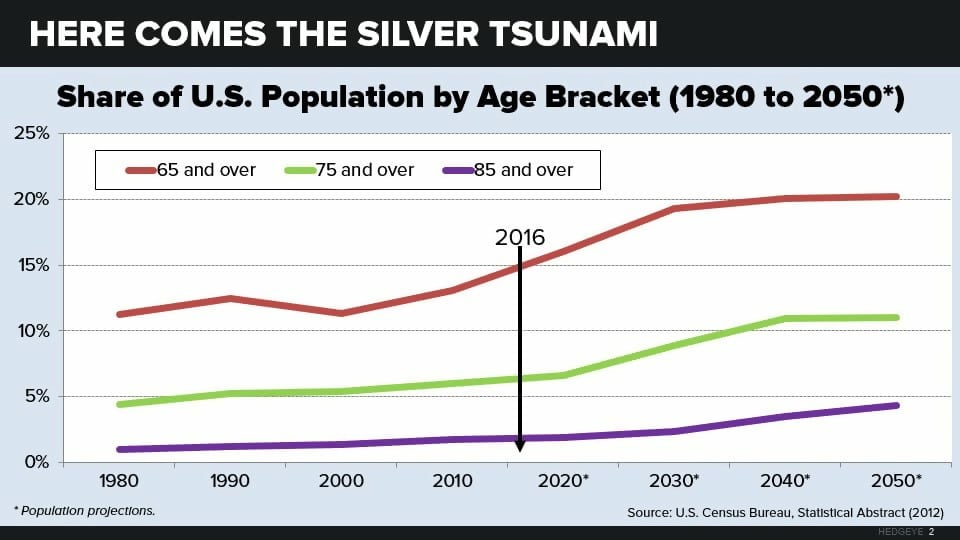

BABY BOOMERS • THE SILVER TSUNAMI

Historically, all real estate goes up and down within its current economy. But, recession-resistant investments are not as affected by the volatility of a current economy. By definition, experts tell us that “Recession Resistant Real Estate Investments” are instead tied to lifestyle trends as opposed to economic cycles. One excellent example of this type of property is senior housing.

With the golden years looming for millions of baby boomers along with the fact that they historically change, well, everything, they are also changing the landscape of senior housing as they retire. For one, they seek a more urban environment than ever before and remain much more active as they grow into their senior years than the generations that came before. Additionally, the baby-boomers’ expectations include not only living assistance when needed but also social interactions and entertainment.

All that adds up to many changes across the continuum brought about by the sheer numbers of this incredible generation. Needless to say, baby boomers literally change real estate investment opportunities and the prospects of future construction in the category of senior housing.

What’s more, they might need full or part-time nursing care. Additionally, their expectations might include help with their daily housekeeping, transportation, and other life skills for which they may need help. This paves the way for an excellent resource for recession-resistant real estate in the category of senior housing.

Moreover, senior housing includes several sub-categories such as age-restricted multifamily communities, independent-living homes, assisted-living homes, homes that specialize in memory care, or even inter-generational housing.

UNDERSTANDING THE TYPES OF SENIOR HOUSING

Before you begin to invest in senior housing it’s important to understand the distinct types available. Some facilities combine services such as memory care while others stick closely to their designations. Senior apartments and nursing homes have the lowest ROI of all senior housing alternatives, while the rest are proving to be good investments over other types of real estate.

• SENIOR APARTMENTS

Senior apartments rent only to those in a certain age group. Local governmental housing authorities have jurisdiction over some of the lower to middle-income properties. However, there are also privately owned and operated properties. This type of senior housing provides only basic housing with very few other types of service.

• INDEPENDENT LIVING FACILITIES

Independent living facilities are for seniors who are still active and do not need help with daily activities. But, this type of property doesn’t supply only housing. Depending on the facility, their amenities may also include three meals per day, regularly scheduled social activities, local transportation resources, and weekly laundry and house-keeping services.

• ASSISTED LIVING FACILITIES

Assisted living facilities provide an elevated level of care for their residents who need help with their daily living activities. So, of course, this involves health care such as a nursing staff for daily medications, baths, dressing, and socializing. Some assisted care facilities also offer memory care units, however, they usually don’t offer a specific level of nursing for memory care.

• MEMORY CARE FACILITIES

Memory care facilities offer highly specialized care for residents with memory loss due to Alzheimer’s disease and other types of dementia. As we stated above, some assisted living homes have memory care units. But it is important to understand that homes that specialize in memory care specifically also hire the type of nursing staff that specialize in skills related to patients with Alzheimer’s disease, dementia, and other memory-related issues. What’s more, many experts believe this to be one of the fastest growing senior housing categories.

• NURSING HOMES

Nursing homes are the most expensive and also offer the highest level of nursing and medical care. These are for residents who must have medical staff present at all times. Most of the income in these communities is from Medicare and Medicaid. These homes are generally one step below a hospital (sub-acute care) and that is the level of services you may expect from these facilities.

• CONTINUING CARE RETIREMENT COMMUNITIES (CCRC)

Continuing care retirement communities supply a combination of services from the categories above. These wide ranges of amenities include independent living, assisted living, memory care, and skilled nursing care. The benefit of this category is that residents get the opportunity to age in place rather than moving around as they get older or need more care. You might find this type of housing in a building with different wings or a single high-rise or several groups of buildings such as duplexes or cottages.

• INTER-GENERATIONAL HOUSING

Intergenerational living combines children, young adults, and seniors in social living activities. The concept is an exceptional one from a social standpoint because it blends families together whose purpose is to build communities based on cooperation and understanding between the generations. That’s because the modern senior is an active, thriving person and wants their lifestyle to reflect that. They want to share the experiences and wisdom of their lifetimes with others rather than living with only people in their own age group. This is an extremely healthy alternative for many reasons for seniors who expect more from life.

UNPRECEDENTED GROWTH • EXPECTED TO CONTINUE

Senior housing is experiencing extraordinary growth and it will continue. Here’s why. First, the Silver Tsunami surge will be prevalent for decades as stated above with 10,000 baby boomers per day reaching the age of 65 for the next 20 years.

Next, there are over 750 cities in the United States with a population of over 50,000. These markets and even those that are smaller will easily sustain new senior housing communities. However, we caution you that due diligence must still take place to determine each market specifically.

LOW SUPPLY • HIGH DEMAND

As a result of this surge in growth of our senior population, the availability of this type of housing is lower than the demand. Moreover, it will continue to be in high demand for decades to come. Some experts estimate that as much as 60,000 new senior housing facilities per year are needed to meet the ever-rising demands.

RECESSION-RESISTANT INVESTMENTS FOR YOU

The recession resiliency of senior housing makes this category of real estate incredibly attractive for you as an investor. However, it is important to realize that senior housing has its own business cycle, just like any other real estate investment. Nevertheless, by the very fact, that it is affected by lifestyle, senior housing investment trends experience fewer ups and downs due to unemployment or the gross national income.

Moreover, as other market trends rise and fall, there is still a high demand for long-term facilities for our aging population. This means that even though there may be many downward trends, senior housing investments will endure. As a result, investments in this type of real estate is low-risk and when due diligence is performed, shows promise of fantastic returns.